TORONTO, ONTARIO, March 5, 2025 – Home buyers continued to benefit from substantial choice in the

Greater Toronto Area (GTA) resale market in February 2025. Home sales last month were down in

comparison to the same period last year, while listing inventory remained high, providing substantial

negotiating power for homebuyers.

"Many households in the GTA are eager to purchase a home, but current mortgage rates make it difficult for

the average household income to comfortably cover monthly payments on a typical property. Fortunately, we

anticipate a decline in borrowing costs in the coming months, which should improve affordability," said

TRREB President Elechia Barry-Sproule.

“On top of lingering affordability concerns, home buyers have arguably become less confident in the

economy. Uncertainty about our trade relationship with the United States has likely prompted some

households to take a wait and see attitude towards buying a home. If trade uncertainty is alleviated and

borrowing costs continue to trend lower, we could see much stronger home sales activity in the second half

of this year,” said TRREB Chief Market Analyst Jason Mercer.

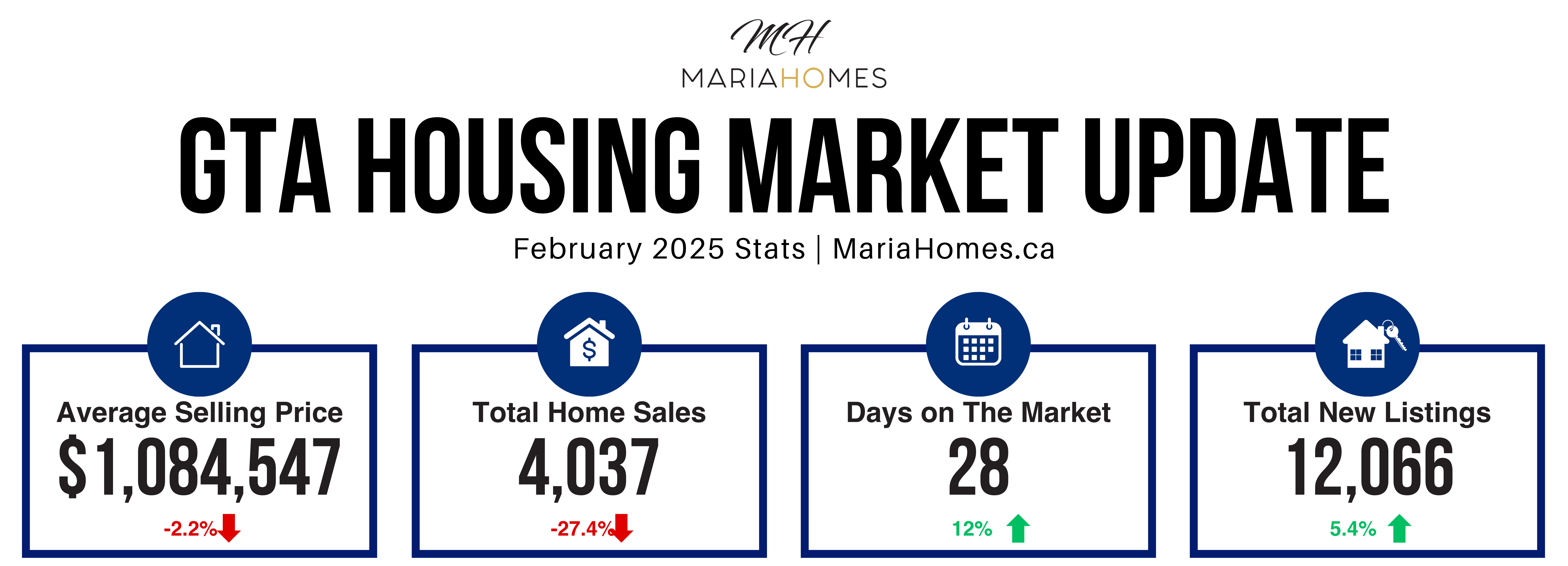

GTA REALTORS® reported 4,037 home sales through TRREB’s MLS® System in February 2025 – down by

27.4 per cent compared to February 2024. New listings in the MLS® System amounted to 12,066 – up by 5.4

per cent year-over-year. On a seasonally adjusted basis, February sales were down month-over-month

compared to January 2025.

The MLS® Home Price Index Composite benchmark was down by 1.8 per cent year-over year in February

2025. The average selling price, at $1,084,547, was down by 2.2 per cent compared to the February 2024.

On a month-over-month basis, the MLS® HPI Composite and the average selling price edged lower after

seasonal adjustment.

“With the Ontario provincial election just behind us and the federal political situation in flux, there is a lot to

consider from a policy perspective when it comes to housing. Not only do existing policy makers and those

vying for high public office need to make clear their direction on housing supply and affordability, but they

also need to be clear on how they intend to tackle issues related to trade and the economy. Clear direction

will go a long way to strengthen consumer confidence,” said TRREB Chief Executive Officer John DiMichele

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !